401k max calculator

A One-Stop Option That Fits Your Retirement Timeline. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

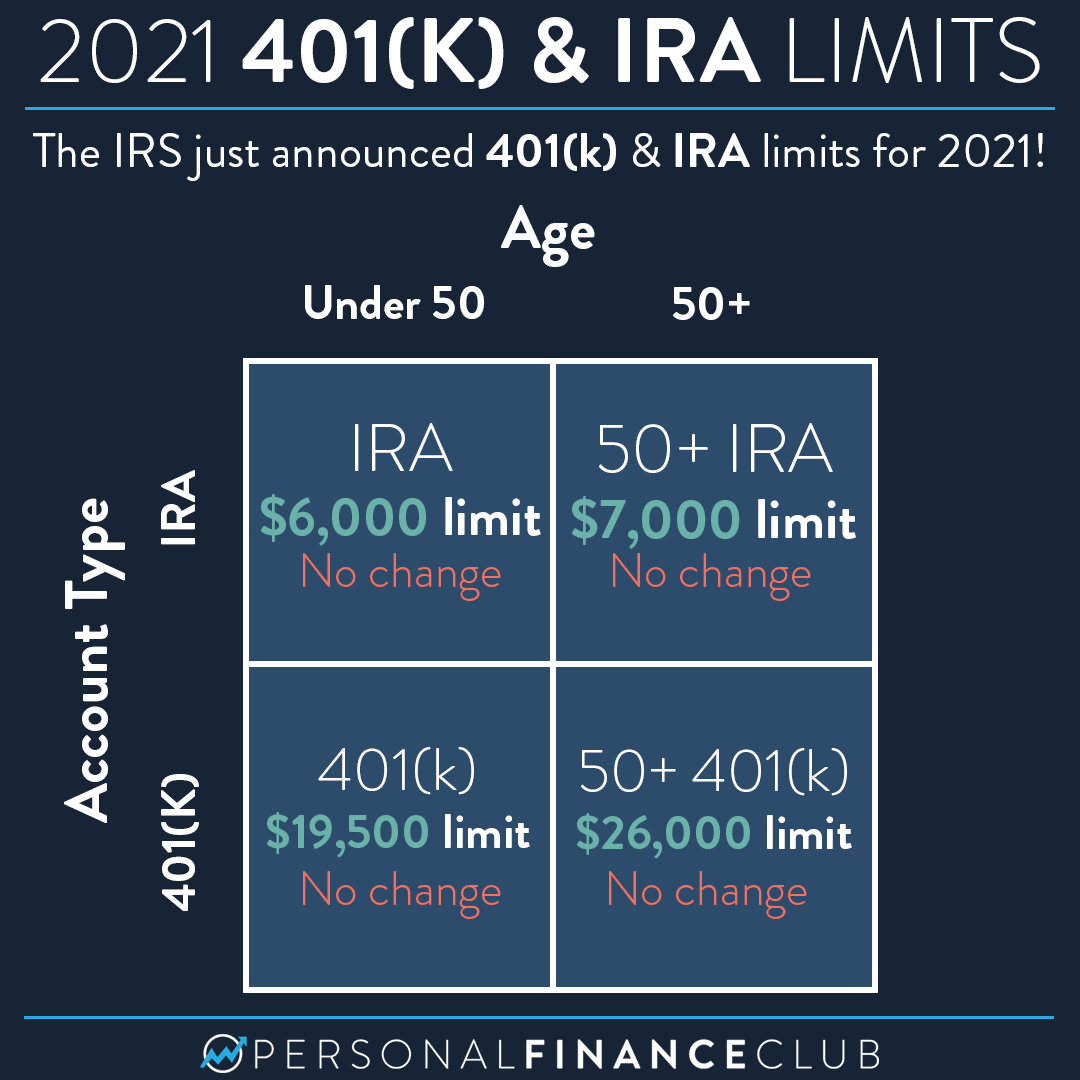

2021 Contribution Limits For 401 K And Ira Personal Finance Club

The contribution limit for 2022 is 20500.

. Use our free calculator at Money Help Center to determine how much you need to save for retirement and how much you need to set aside each month. Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings. Ad Maximize Your Savings With These 401K Contribution Tips From AARP.

State Date State Federal. Ad Compare 2022s Best Gold IRAs from Top Providers. This calculator has been updated to.

This 401 Retirement Calculator will calculate how much your 401 will be worth by the time you reach the age you plan to retire. If you are age 50 or over a catch-up provision allows you to. Knowing how much you need to.

Learn About 2021 Contribution Limits Today. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income.

Ad Discover The Benefits Of A Traditional IRA. See the impact of employer contributions different rates of return and time horizon. For those age 49 and under the limit is 61000 in 2022 up from 58000 in 2021.

The calculator includes options for factoring in. A Solo 401 k. The annual maximum for 2022 is 20500.

Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo. Ad Discover The Benefits Of A Traditional IRA. The problem in attempting to front load and max out the 401k for the year is trying to calculate exactly what the contributions.

Monthly 401k Balance at. Forbes Advisors 401 k calculator can help you understand how much you can save factoring in your expected age of retirement total contributions employers matching. It provides you with two important advantages.

Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. Solo 401k Contribution Calculator Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Plan For the Retirement You Want With Tips and Tools From AARP.

Your annual 401 k contribution is subject to maximum limits established by the IRS. The limits for 2020 and 2021 set by the IRS are 19500 for a 401K plan. Reviews Trusted by Over 45000000.

Contribution to 401 k S x C S x C x E 140000 25 140000 25 30 45500 Now here an individuals contribution cannot exceed 19000 and hence the. A One-Stop Option That Fits Your Retirement Timeline. 401k Retirement Calculator Calculate your retirement earnings and more A 401 k can be one of your best tools for creating a secure retirement.

Learn About 2021 Contribution Limits Today. 401k Calculator Project how much your 401 k will give you in retirement. 401k Front Loading Some Complications.

Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo. Select a state to. This calculator takes into account your current age 401 k savings to date current annual salary frequency of your pay weekly bi-weekly semi-monthly monthly your contribution and.

Consider a defined benefit plan if you want to contribute more. You may find that your employer matches or makes part of your contributions. There is an upper limit to the combined amount you and your employer can contribute to defined 401 ks.

Roth Ira Vs 401 K Roth Ira Calculator Stashing Dollars Roth Ira Roth Ira

Here Is Where Your 401k Savings Vs Your Age Net Worth Good Work Ethic Personal Finance Blogs

The Maximum 401k Contribution Limit Financial Samurai

Roth Ira Vs 401 K How Can You Get Maximum Benefit Roth Ira Investing Money Ira

Roth Ira Vs 401 K Which Is Better For You Roth Ira Roth Ira Investing Ira Investment

What Are The Maximum 401 K Contribution Limits Money Concepts Saving For Retirement 401k

401k Contribution Calculator Step By Step Guide With Examples

Customizable 401k Calculator And Retirement Analysis Template

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

Max Out 401 K 401k Investing Investing Personal Finance Advice

Retirement Services 401 K Calculator

The Maximum 401k Contribution Limit Financial Samurai

Free 401k Calculator For Excel Calculate Your 401k Savings

The Average 401k Balance By Age Personal Capital

Solo 401 K A Retirement Plan For The Self Employed Individual Rules Travel Credit Cards Small Business Credit Cards Travel Rewards Credit Cards

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira